How foundations are choosing their investments and engaging with companies to shape the future

Philanthropy has an unlikely but critical superpower, as Danielle Walker-Palmour says in her lead article: investment. European foundations have over 500 billion euros in assets, stored not in vaults but in the global companies that shape our world. And while foundation investment directors might look more like Bruce Wayne than Batman, they are increasingly taking action to protect the long-term value of their investments and to facilitate impact in line with their charitable objectives.

To this end, they have two weapons – asset selection and engagement.

The power of asset selection is in choosing which companies a foundation owns and, critically, which companies they give working capital to through the purchase of bonds or private equity investments. Selecting assets whose activities align with your charitable objectives is one option; another is avoiding companies or sectors that you don’t want to own. The good news is that studies show this could lead to improved performance and better resistance to shocks like coronavirus.

Foundations have the legal right and the moral authority to put their money where their values are, as well as making their voice heard right across the financial system.

Engagement is less well known but can be just as powerful. Finance teams can use the power of their assets to influence the firms that manage their money, regulators setting the rules of the financial system, and the companies that they indirectly own.

So what is stopping foundation investment directors from becoming a powerful voice for investment and corporate responsibility? First, most are yet to discover their powers. They continue to see their investments as rainy day money or a stable income source, not as a tool for impact alongside delivery and grantmaking. Foundations have the legal right and the moral authority to put their money where their values are, as well as making their voice heard right across the financial system. Secondly, it is difficult to know what ‘good’ looks like, or where to find it. For example, investors struggle to separate ‘green-wash’ from real impact, due to the boom in ESG products on the market. That makes it easy for asset managers to say a lot, do little and claim the impact of others as their own. We will focus here on this second challenge.

Members of the European Responsible Investment Network.

Seven years ago, a group of UK charities joined forces, forming the Charities Responsible Investment Network. ‘As institutions existing for public benefit, charities must look beyond their individual investment portfolios and collaborate with peers and civil society organisations in support of a rapid, just energy transition,’ says Dominic Burke, investment director of Lankelly Chase Foundation. Foundations across Europe are increasingly concerned about the implementation of the Paris climate agreement. As the guiding star of the global fight for climate justice, funders are unsurprisingly funnelling large sums towards climate solutions that support the Paris accord. But what about the damage – and the opportunities – of their investment portfolios?

Funders want to use both of their ‘superpowers’, but often struggle to understand the complexities of the issue.

Europe is without question leading best practice in responsible investment. However, experience about the best ways to fashion and use our two ‘secret weapons’ is scattered across the continent. In the Netherlands and France, investors have supported the implementation of progressive regulatory initiatives, the French Energy Transition Law and the Dutch Climate Agreement. Both have helped to push investor performance in the right direction and, in Denmark, asset owners such as pension funds are recognised for their approach to member engagement, as many funds have built close relationships with their members to facilitate discussion and input on climate change strategies. However, when looking at ‘portfolio Paris alignment’, asset managers across the continent are scrabbling to claim the best methodology. Yet some approaches are better than others, and some simply compare apples and oranges without explaining the difference. A classic example of this is that some methods focus on either asset allocation or engagement and disregard the role of the other for building a zero carbon investment system.

When looking to understand and improve practice on this topic, philanthropists have often turned to civil society organisations with expertise in the field. The European Responsible Investment Network (ERIN) is a pan-European community of CSOs working to raise standards across the continent. Members of the group engage with companies and their shareholders on a wide range of social and environmental themes, and work to shape national government and EU financial sector regulation.

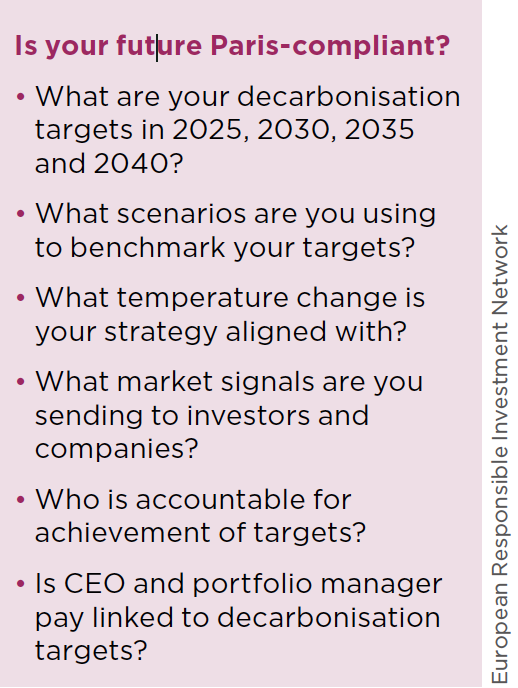

For example, the Danish civil society organisation Responsible Future has capitalised on the positive approach to pension saver engagement in their country, and has called for pension funds to divest from fossil fuels. They joined a working group of ERIN members grappling with the technicalities of ‘portfolio Paris alignment’. The group are developing a ‘checklist’ of key features of an investment portfolio aiming to contribute to building a Paris-compliant future. Through collaborative cross-continental initiatives like these, civil society has a key role to play in maintaining and raising standards of responsible investment.

Funders want to use both of their ‘superpowers’, but often struggle to understand the complexities of the issue. As Richard Robinson, investment director of Paul Hamlyn Foundation says, ‘We have to learn from each other as this space is evolving rapidly. Expectations of improved behaviour, participation and governance make peer networks supremely valuable.’ Members of ERIN are hoping to draw on the expertise of civil society to find out what ‘good’ looks like, and to implement it. To realise their true potential, these superheroes have teamed up across Europe to learn from each other, transform together, and save the world.

Lily Tomson is head of Networks at ShareAction.

Email: lily.tomson@shareaction.org

Twitter: @LilyMTomson

Comments (0)